Bitcoin formula

Bitcoin is a decentralized digital currency that has gained popularity in recent years, but one question that remains unanswered is: who controls bitcoin? Various articles have delved into this topic, offering insights into the different aspects of control within the bitcoin ecosystem. From the role of miners to the influence of developers, understanding the dynamics of control in the world of bitcoin is crucial for anyone looking to navigate this complex landscape. The following list of articles provides valuable information on who controls bitcoin, shedding light on the key players and factors at play in this decentralized system.

The Battle for Control: Miners vs. Developers in the Bitcoin Network

In the world of Bitcoin, a fierce battle for control has been raging between miners and developers. This struggle for dominance has been at the core of the cryptocurrency's evolution, shaping its trajectory and impacting its overall success.

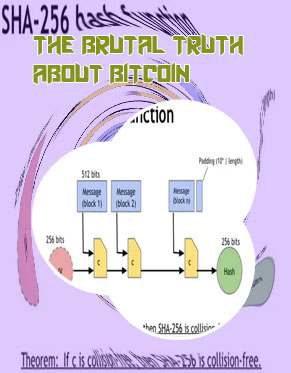

Miners, the individuals or groups responsible for verifying transactions on the Bitcoin network, play a crucial role in maintaining the system's integrity. By solving complex mathematical puzzles, miners are rewarded with new bitcoins and transaction fees. Their power lies in their ability to control the network's processing power, known as hash rate, which determines the speed and security of transactions.

On the other side of the battle are developers, the innovators behind Bitcoin's software updates and improvements. These individuals work tirelessly to enhance the network's functionality, scalability, and security, ensuring its continued relevance in the ever-evolving landscape of digital currencies.

The clash between miners and developers has led to contentious debates and disagreements over issues such as block size limits, transaction fees, and network upgrades. These conflicts have often resulted in hard forks, where the Bitcoin blockchain splits into two separate chains with different protocols.

Despite these challenges, the Bitcoin network has continued to thrive, thanks to the resilience and ingenuity of its community. As the battle for control rages on, one thing remains clear: the future of Bitcoin

Exploring the Role of Whales in Bitcoin: Who Really Holds the Power?

The concept of whale wallets in the world of Bitcoin has long been a topic of fascination and debate among cryptocurrency enthusiasts. These large holders of Bitcoin have the power to influence the market and drive significant price movements with their buying and selling activities. This article delves into the role that these whales play in the Bitcoin ecosystem, shedding light on who really holds the power in the world of cryptocurrency.

By analyzing the transactions and holdings of these whale wallets, researchers have been able to gain insights into the behavior of these influential players. It is clear that whale wallets hold a significant portion of the total supply of Bitcoin, giving them the ability to sway market sentiment and drive price action in their favor. This concentration of wealth among a small group of individuals raises questions about the decentralization and democratization of Bitcoin, as the power to influence the market is disproportionately concentrated in the hands of a few.

To better understand the dynamics at play in the world of Bitcoin whales, further research could explore the motivations behind their buying and selling activities. Additionally, examining the impact of whale activity on market volatility and liquidity could provide valuable insights into how these influential players shape the cryptocurrency landscape. Finally, considering the potential regulatory implications of whale activity in the Bitcoin market could shed light on how policymakers might address concerns about market manipulation and

Decentralization or Centralization? The Debate Over Governance in Bitcoin

Bitcoin, the world's first decentralized cryptocurrency, has sparked a heated debate over governance. Some argue for a decentralized approach, emphasizing the importance of individual autonomy and freedom from centralized control. Others advocate for centralization, citing the need for efficient decision-making and scalability.

Proponents of decentralization point to the core principles of Bitcoin, such as censorship resistance and immutability, as evidence of its superiority. They argue that a decentralized system is more resistant to censorship and government interference, making it a more secure and reliable form of money.

On the other hand, proponents of centralization argue that a more centralized approach is necessary for Bitcoin to achieve widespread adoption and scalability. They believe that a centralized governance structure can help address issues such as network congestion and high transaction fees, making Bitcoin more user-friendly and accessible to the masses.

Ultimately, the debate over governance in Bitcoin is a complex and nuanced one, with valid arguments on both sides. As the cryptocurrency continues to evolve and mature, finding the right balance between decentralization and centralization will be crucial in ensuring its long-term success.

Key points to consider:

- The importance of individual autonomy and freedom in a decentralized system.

- The need for efficient decision-making and scalability in a centralized system.

- The core

Unraveling the Mystery: Who Holds the Keys to Bitcoin's Future?

Bitcoin, the world's first decentralized digital currency, has been the subject of much speculation and debate since its inception. As the popularity of Bitcoin continues to grow, so too does the question of who holds the keys to its future.

One of the key players in the Bitcoin ecosystem is the group of developers who maintain and update the software that powers the network. These developers play a crucial role in deciding the direction of Bitcoin by proposing and implementing changes to the code. However, their power is not absolute, as any proposed changes must be accepted by the broader community of users and miners.

Another important group in the Bitcoin ecosystem is the miners, who validate transactions on the network and secure it against attacks. Miners are incentivized to act in the best interest of the network by earning rewards in the form of newly minted bitcoins. However, their influence over the future of Bitcoin is limited by the need to reach a consensus with the rest of the network.

Ultimately, the future of Bitcoin is in the hands of its diverse and decentralized community of users, developers, and miners. By working together to find common ground and make decisions that benefit the network as a whole, they hold the keys to unlocking Bitcoin's full potential.