Bitcoin margin trading

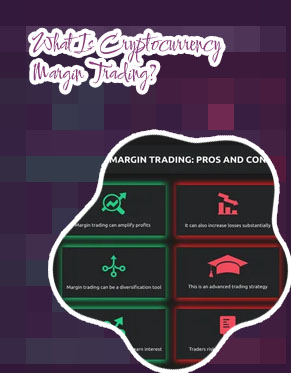

Crypto Margin Trading: Pros and Cons

In other words, technical jargon aside, the concept here is: margin trading allows you to make bigger bets than you otherwise would at the cost of extra fees and extra risks. When you make a bet, you can use the lender’s money, but if the bet goes the wrong way, the funds come out of your pocket. You take all the risks (although if you ever can’t cover your margin call, exchanges typically have an insurance fund and will socialize losses between other margin traders as a last resort… the money must always come from somewhere). How to margin trade crypto There are two ways of investing in cryptocurrency, mining and via exchanges. Cryptocurrency mining is considered the procedure of verifying and adding transactions to the blockchain public ledger. Another option is via cryptocurrency exchanges. Exchanges generate money by collecting transaction fees, but there are alternative websites where you can interact directly with other users who want to trade cryptocurrencies.Trading crypto on margin

Let's consider a margin trading crypto example where a trader starts with a capital of $10,000. They use an isolated margin approach, allocating $1,000 as margin to open positions. The trader believes that the price of Bitcoin (BTC) will rise, so they open a "long" position by buying 1 BTC at the current price of $40,000. How Do You Best Manage Risk With Crypto Margin Trading? As is the situation in the UK, the CRA has not yet released any guidelines on how crypto margin trading will be treated from a tax perspective. In line with their treatment of other cryptocurrency activities, there is the potential that margin trading gains/losses will be treated with income tax if the owner is a business entity, or capital gains tax if the owner is an individual. We recommend talking to a tax professional to determine what’s best for your personal circumstances

The Cons Of Crypto Margin Trading

Whenever someone holds a lot of a crypto asset, like Bitcoin, it’s considered a long position. To hedge against the high price volatility that accompanies the crypto asset in question, traders can hedge against the position by placing a leveraged short position. So, whenever the price of the crypto asset falls, the short position rises in value, allowing investors to recoup a portion of the money lost during the leverage trades. What types of Bitcoin Traders are there? $Margin crypto

Margin trading lets you borrow money from an exchange to open bigger positions than you could with your own capital alone. The higher the leverage, the less actual money you need to ante up from your own stack — but the quicker it can disappear if your wager goes awry. To stay in the game, you've got to keep up your margin. And that’s fairly easy to do, as long as Lady Luck keeps smiling your way. But the moment the market turns against you and your equity (account balance + profit/loss) falls below the margin requirement, you’ll face a dreaded margin call. That means you’ll need to add more funds quickly or fold. And when you fold, the exchange is coming for everything left on the table. 3. Uneducated wagers are the ones at risk By comparison, in non-leveraged crypto trades, when you invest in a coin or token, your profit or loss is one-to-one, without a multiplier. The amount by which the price changes when you sell or trade to another asset is your profit (or loss) on the trade.