The Fall of the Bitcoin and its Impact on Gambling

In 2013 a new virtual currency came about called “Bitcoins.” Unlike money in the real world where we equate a single bill to it’s same value in gold, these “bitcoins” are on a separate worth system only online, and not regulated by a central authority such as the Federal Reserve. The oddest thing about these coins is the way they are obtained, they are encrypted into computers, programs, or complex mathematical algorithms. Which led to some hackers taking over peoples computers just to harness their computing power to retrieve this imaginary currency. Once these coins are found, they are stored in an online “wallet” for safekeeping, and are watched over by a third party.

Unlike banks or financial firms, this third party will not invest your “bitcoins,” nor will they replace any stolen money or even offer anything more than “protection” of the coins. As well, these coins are untraceable, so if your coins were stolen from your online “wallet,” there would be nothing anyone could do for you to get them back, or a hold a party responsible for the theft. Then add in the fact that there are a finite amount of coins in the whole world (about 21 million), and you have a real race of programmers, hackers, and regular people.

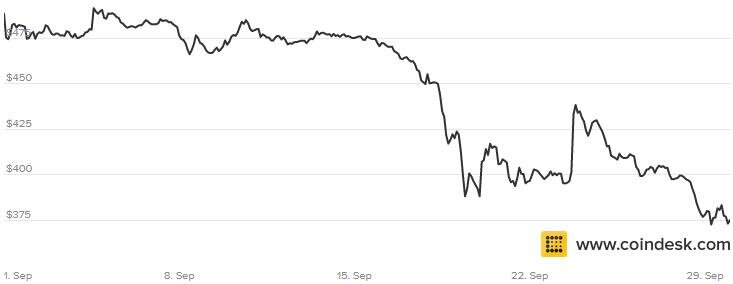

Each “bitcoin” acts very similar to regular currency in the fact that it also rises and drops in value due to certain circumstances. The circumstances themselves are not available to the public, and remain solely with “bitcoin” and its distributors. Late 2013 the rate of BTC (bitcoin) to USD (United States Dollar) was at a rate of over 1 to 1,000. Meaning one “bitcoin” was worth over a thousand american dollars, well over unbelievable rates. This price dropped dramatically in early 2014 to under $300 USD, then dropped an additional 40% at the beginning of 2015, putting it more near $120 USD. The rate has continued to drop due to the internal system for obtaining “bitcoins,” known as “mining.” More miners equals less “bitcoins” to go around, the more coins that are mined, the less value each coin has.

This continual drop rate will also start to affect gambling establishments who use such currency. Most gambling operators who accept “bitcoins” as a form of currency are online as well. So the use of such currency has made it easier on them, not needing an additional third-party to turn players cash into online, in-house currency. So if the “bitcoin” cash cow is starting to die off, then what will this spell for BTC gambling operators and casinos? Mainly it will just mean that they will need to find a new form of electronic currency, if the operator is world wide, they will need a way to convert different currency to their own; or it might just mean the death of BTC operators in the gambling sector.

Most of which are already in a legal grey-area using the coins to begin with. Because its not regulated by any authority, it means that the cash that the coins offer, can be used for illicit dealing with money, such as laundering. As for the actual state of “bitcoins” and BTC operators, currently it’s not looking good, but that doesn’t mean they are down and out. There have been crazier come-back stories. Regardless, each country will need to look into their own currency systems and decide if they will allow “bitcoin” and BTC operators to be a legit and legal operation.